Taxlendar: Tax Deductions&Log

They care every penny they spent on business, want to reduce the adminstrative burden to track tax related expenses, and wonder how to leverage their work calendar as tax log to track work/tax related expenses. Thats why we build Taxlendar.

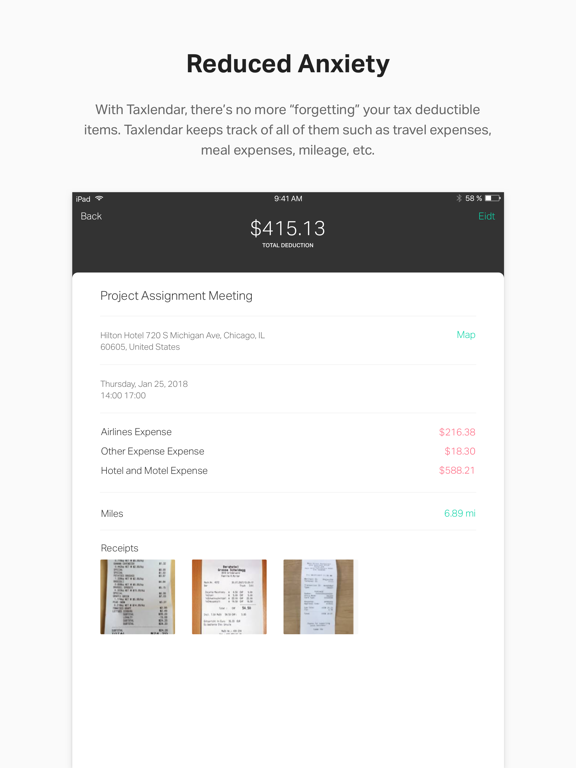

Taxlendar will eliminate the need for your weekly monthly tax related activity log leveraging your existing work calendar. It significantly reduces your administrative time at tracking your tax deductions and help you get organized so you don’t have that anxiety during annual tax season scrambling for data.

• Once you create your work schedule/appointments/events/activities in your regular calendar app such as iCalendar, Taxlendar will sync your schedule automatically.

• The only thing you need to do is that take your phone with you when you attend your event. The Taxlendar will calculate your mileage automatically as long as location is entered on your calendar as well. If you have an event on schedule that you don’t plan to attend, no worries. Taxlendar will automatically detect you are not there and mileage won’t be calculated.

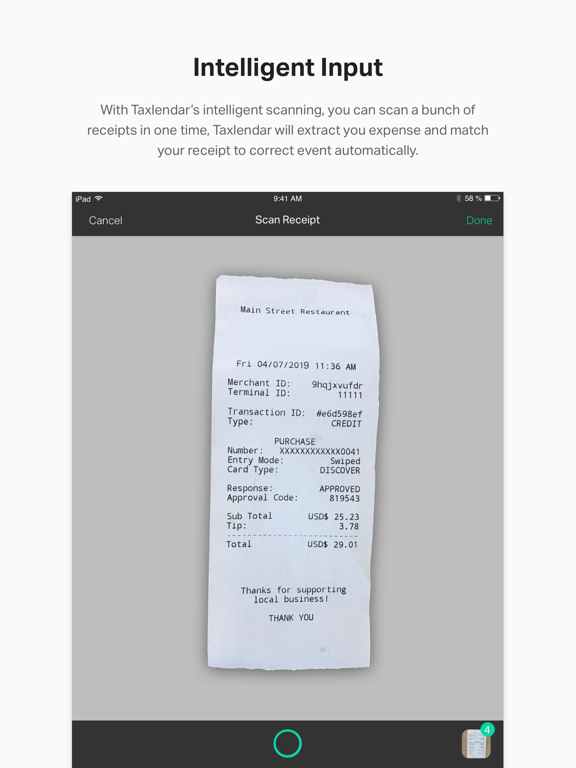

• Don’t have time to scan receipts right after the event/meeting? Scan all your receipts when you get some free moments, Taxlendar will find the correct event/meeting on your calendar based on the time on the receipt and save your receipts with that event/meeting.

• Need a tax log to give to your CPA/accountant? Just export your detailed tax log by clicking few buttons in Taxlendar! “Travel expense”, “Meal and Lodging”, “Vehicle Expense” and “Other expense” can be exported right away! Also, your receipt images will be attached.

Taxlendar is the easiest most convenient way to record your mileages and tax deductions. Simply synchronize with your calendar, and leave the rest to us!

Taxlendar is only $0.99/month (first month free), but you save $11,000 per year on average!

Automatic Mileage Detection

Whenever you arrive at business location, Taxlendar detects that arrival and record it as a mileage deduction.

More Tax Deduction

You can also input your business expenditures: starbucks, meal, tips, tolls, parking, etc.

Intelligent Receipt Scanning

You can scan a bunch of receipts in one time, Taxlendar will extract you expense and match your receipts to correct events automatically.

Making Your Business Mileage Count

Begining on 2020, IRS mileage rate is 57.5 cents per mile driven for business.

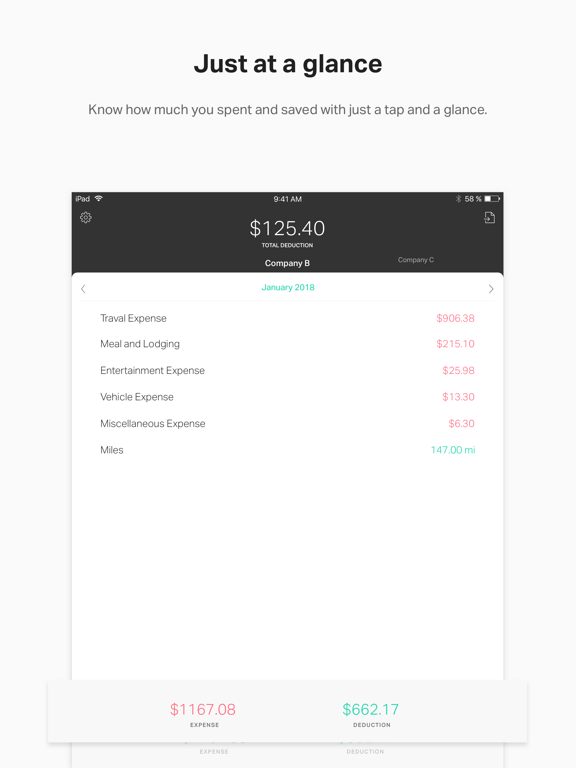

Detailed Report

With Taxlendar, you can easily export a report with all your tax deduction details which follow IRS standards.

Use Tips

• Please make sure you enter your defualt home address. Taxlendar needs this address to keep track of your mileage generated throughout the day. You can also set the default address to your hotel address when you are traveling.

• Please enable your location services and background refresh services so that Taxlendar can keep track of the tax deductible items related to mileage.

• Please enable your notification services. Taxlendar’s notification serves as a reminder to maximize your tax deduction amount.

• Please open Taxlendar every 3 days to keep your events synchronized.

Learn more

• Website: http://taxlendar.com

• Terms of Service: https://goo.gl/qamBeZ

Subscription Details

• Payment will be charged to your iTunes account at confirmation of purchase

• Subscription automatically renews unless the auto-renew is turned off at least 24-hours before the end of the current period

• Your account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal

• Subscriptions may be managed by the user and auto-renewal may be turned off by going to the users account settings after purchase